Our Housing Counseling Manager meets one-on-one with families to assess their financial situations, discuss options and develop plans designed to fit their unique needs. With this plan, families get out of debt, stay out of debt and stay in their homes!

We help families:

We also help with:

For more information or to set up an appointment, email clientservices@ahfh.org.

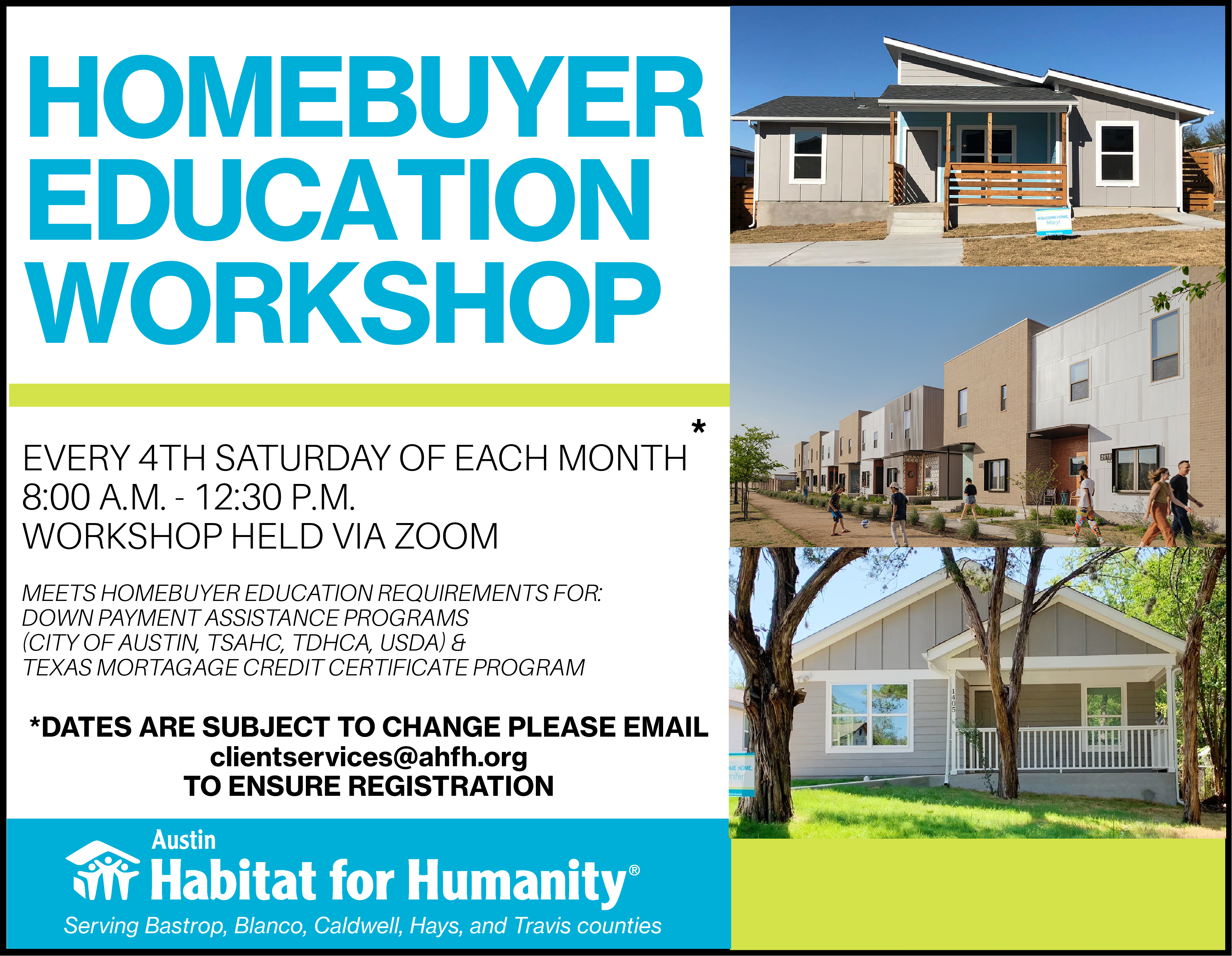

If you dream of owning your own home, it can become a reality if you set realistic goals, get sound advice, plan carefully, and understand the costs. This course, open to all first-time homebuyers, will help you understand:

Understanding credit is an important part of the home buying process and financial security. Your credit demonstrates your ability to borrow money and pay it back. This class will teach you the importance of maintaining good credit and give you tools and tips to improve your credit rating. It will help you understand:

Managing your personal finances wisely is an important part of the home buying process and a critical step in achieving financial security. Buying a home may involve changing your spending habits so you can afford the routine costs of homeownership. This class will give you tips on how to manage your money so it doesn’t manage you. You will learn how to:

Austin Habitat for Humanity utilizes curriculum and training materials from the NeighborWorks Center for Homeownership Education and Counseling.

AUSTIN HABITAT FOR HUMANITY IS NOT AN INTAKE CENTER, ONLY A HOUSING COUNSELING AGENCY

For more information or to set up an appointment, email clientservices@ahfh.org with the subject line HOMEOWNERSHIP FORECLOSURE PREVENTION.